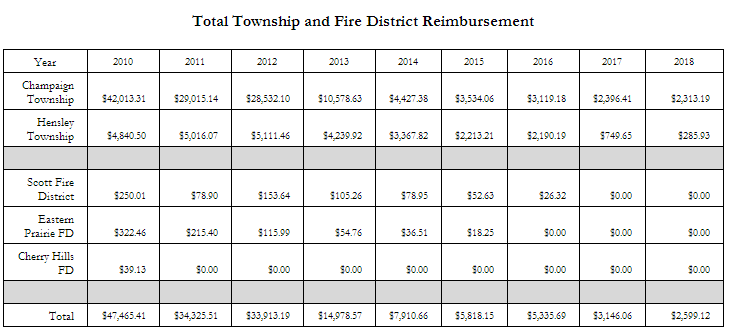

In accordance with State law, after annexation of property, the City of Champaign is required to reimburse the Townships and Fire Districts for the loss of revenue they experience. The City reimburses the townships for ten years after an annexation, and the fire districts are reimbursed for five years, with the amount decreasing by twenty percent each year. The Planning & Development Department calculates the total Equalized Assessed Values for all of the annexations that occur in a year, and then uses the tax rates for each taxing district to reimburse the townships and the fire districts, as shown below. In recent years, the City has been requiring new fringe development to provide for contiguity and annexation prior to the start of development. This results in the township reimbursement being based on the undeveloped land value. The table below shows this approach reduces the amount of the township reimbursement.

State law requires that payments for the townships are made twice a year: once in July and once in December. These payments are made for the previous fiscal year. The payments for the Fire Districts are made once in December for the previous calendar year. For December, the City will pay the following amount to two townships and three fire districts:

- Hensley Township – $2,555.73 (December Payment)

- Champaign Township – $14,266.05 (December Payment)

- Scott Fire District – $153.64 (Annual Payment made in December)

- Eastern Prairie Fire District – $115.99 (Annual Payment made in December)

Total December Reimbursement – $17,091.41

Total Annual Reimbursement – $33,913.19

Last year, there were five annexations to the City of Champaign. All five parcels were surrounded by the City of Champaign and they were tracts of land that were left from previous development. One of the properties was a house, while the other properties were a cell tower, detention basin, and a utility pump station. Two of the properties were in Hensley Township and the other three were in Champaign Township. Of the five properties, only one paid into a fire district, which was Scott Fire Protection District.

In recent years, the City of Champaign has worked to annex proposed development prior to construction. This both reduces urban sprawl and the inefficient extension of services to new development on the perimeter of the City. It also allows the City to annex the property at an agricultural rate rather than the rate for developed properties, which greatly reduces the amount of money reimbursed over time. Below is the amount of reimbursement by year that the City has paid to the other taxing agencies. The amount reimbursed has steadily dropped over the years.