Please note this is an archived news post from January 2014 and is now outdated. For current information about tax rates in Champaign please visit the Business Portal section of our website.

The City increased its Home-Rule Sales Tax by 0.25% effective January 1, 2014 to increase Police and Fire services.

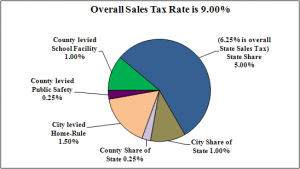

The overall sales tax rate for most purchases in the City of Champaign is as follows:

- State: 5.00%

- City Share of State: 1.00%

- County Share of State: 0.25%

- County-Public Safety: 0.25%

- County-School Facility: 1.00%

- City-Home Rule: 1.50%

TOTAL: 9.00%

Home-Rule Sales Tax applies only to sales of general merchandise, and is not charged on sales of items which require title or registration (such as automobiles), or to the sales of groceries, drugs, or medical appliances.

The tax on sales of groceries, drugs and medical appliances is 1%.

The current Food and Beverage Tax is 0.50%, therefore the total tax on food and beverages sold for immediate consumption is 9.50%.

The tax on sales of vehicles is 6.25%.